mika

Still Wondering

TodayÔÇÖs Birthdays / Calendar

A CORPORATE VIRAL FOOL EDITION

A CORPORATE VIRAL FOOL EDITION

BMW Website Review:

BMW Sauber F1

BMW Motorsport

BMW Yachtsport

BMW Golfsport

BMW Oracle Racing

BMW Sport website

worldofbmw.com: Kicking around in Karoo

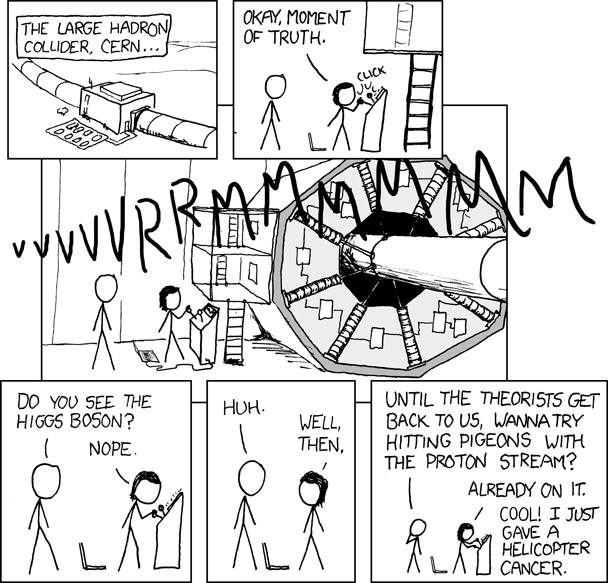

Talks Brian Cox: What really goes on at the Large Hadron Collider

<!--cut and paste--><object classid="clsid:d27cdb6e-ae6d-11cf-96b8-444553540000" codebase="http://download.macromedia.com/pub/shockwave/cabs/flash/swflash.cab#version=8,0,0,0" width="432" height="285" id="VE_Player" align="middle"><param name="movie" value="http://static.videoegg.com/ted2/flash/loader.swf"><PARAM NAME="FlashVars" VALUE="bgColor=FFFFFF&file=http://static.videoegg.com/ted/movies/BrianCox_2008_high.flv&autoPlay=false&fullscreenURL=http://static.videoegg.com/ted/flash/fullscreen.html&forcePlay=false&logo=&allowFullscreen=true"><param name="quality" value="high"><param name="allowScriptAccess" value="always"><param name="bgcolor" value="#FFFFFF"><param name="scale" value="noscale"><param name="wmode" value="window"><embed src="http://static.videoegg.com/ted2/flash/loader.swf" FlashVars="bgColor=FFFFFF&file=http://static.videoegg.com/ted/movies/BrianCox_2008_high.flv&autoPlay=false&fullscreenURL=http://static.videoegg.com/ted/flash/fullscreen.html&forcePlay=false&logo=&allowFullscreen=true" quality="high" allowScriptAccess="always" bgcolor="#FFFFFF" scale="noscale" wmode="window" width="432" height="285" name="VE_Player" align="middle" type="application/x-shockwave-flash" pluginspage="http://www.macromedia.com/go/getflashplayer"></object>

How do I learn more about becoming a BMW motorcycle dealer?

BMW Motorrad USA regularly performs market studies to determine the optimal locations in which to open new BMW motorcycle dealerships.

At this time, BMW motorcycles is seeking qualified candidates for the establishment of a new dealership in Cincinnati, Ohio; Duncansville, PA; Ocala, Florida; Philadelphia, PA; and Leesburg, Virginia.

If there are other markets that interest you, please send a letter of interest indicating the specific market along with your resume and personal financial statement to:

Dealer Development Manager | BMW Motorrad USA

P.O. Box 1227

Westwood, NJ 07675 - 1227

Please note that at this time we are only accepting applications from individuals with established motorcycle industry experience.

BMW PressClub

BMW G 650 XCHALLENGE OFFERS OFF-ROAD PATROL BENEFITS TO BAKERSFIELD, CA POLICE DEPARTMENT

04/29/2008

Woodcliff Lake, NJ - April 29, 2008... Bakersfield, CA police officers are now patrolling the bikeway along the Kern River with greater ease and safety, thanks to two new BMW G 650 Xchallenge motorcycles recently delivered to the department by Valley Cycle and Motorsports in Bakersfield.

According to Frank Stevens, Authority Program Manager for BMW Motorrad USA, the Bakersfield Police Department is the first law enforcement agency to purchase the G 650 Xchallenge for patrol purposes.

ÔÇ£We have sold the F 650 GS-P -- also an agile, multi-terrain motor -- to law enforcement agencies for many years,ÔÇØ commented Mr. Stevens, ÔÇ£but the G 650 Xchallenge offers greater off-road capabilities with longer suspension travel and higher ground clearance for more aggressive off-road riding.ÔÇØ

ÔÇ£Officers will be patrolling the entire Kern River bottom on motorcycles equipped with patrol lights, anti-lock brakes and radios,ÔÇØ said Bill Abshier, owner and general manager of Valley Cycle and Motorcycles. ÔÇ£We hope to be successful adding R 1200 RT-P models to the Bakersfield Police DepartmentÔÇÖs street bike fleet in the near future.ÔÇØ

The BMW G 650 Xchallenge - a runner-up in the "Best Dirtbike" category for Motorcyclist magazineÔÇÖs 2007 Motorcycle of the Year Award ÔÇô is BMWÔÇÖs most modern and aggressive dual sport bike, distinguished by its outstanding off-road riding performance and its air damping system.

BMW police motorcycles are currently used by more than 400 agencies throughout the United States, including the State of Washington, Oregon, California, Arizona, New Mexico, Nevada and Idaho to name a few.

For more information about the features and benefits of BMW police motorcycles, visit BMWÔÇÖs exclusive police motors website at www.bmwmc.net or learn more about the complete line of BMW motorcycles at www.bmwmotorcycles.com.

3-D VIRTUAL TOUR OF FIRST-EVER BMW X6 TO ROLL INTO LOBBIES OF BUILDINGS NEAR WALL STREET AS CENTERPIECE OF AD CAMPAIGN

04/29/2008

BMW of North America Banking on Dynamic Hologram of World's First Sports Activity Coupe to Reach Target Consumers in Financial Community

Woodcliff Lake, NJ - April 29, 2008... BMW of North America and its advertising agency GSD&M Idea City are rolling out a 3-D virtual vehicle tour to herald the arrival of the first-ever BMW X6. Going direct to target consumers with a hologram of the vehicle, the world's first sports activity coupe will be featured in prominent buildings in New York City's financial district over a four-week period.

Employing patented technology from Dutch advertising company viZoo, the 2008 BMW X6 will be projected in three dimensions, appearing as a hologram, inside a ten-foot square, BMW-branded enclosure. Inside the light-controlled space, an animation suggesting the vehicle's unique combination of coupe agility and sports activity vehicle versatility runs on a loop.

"Busy finance executives represent an important sampling of the target consumers for the new BMW X6," said Jack Pitney, Vice President, Marketing, BMW of North America. "Since these prospective buyers rarely have time to visit a dealer showroom, our virtual tour allows them to 'experience' the performance, agility and utility of the X6 by bringing the showroom to them."

An interactive touch-screen inside the enclosure will allow people to manipulate the vehicle hologram to view different angles, experience the interior, explore the vehicle features, and get a sense of the generous cargo space.

"The BMW X6 doesn't look like anything BMW has ever produced - you have to see it to believe it," said Duff Stewart, President and COO of GSD&M Idea City. "Our goal was to put this amazing vehicle in front of its best prospects and stop them in their tracks."

The BMW X6 virtual tours will be open in each New York City location on Monday through Friday during regular office hours, and will be staffed by brand ambassadors during peak times. The building locations and dates are as follows:

* World Financial Center (225 Liberty St.) from April 21st - April 25th

* 245 Park Ave. from April 28th - May 2nd

* 1 Liberty Plaza from May 5th - May 9th

* 1 New York Plaza from May 12th - May 16th.

A media partnership has been forged with CNBC-TV to help further the BMW X6's reach among members of the financial and business community. On the television news network, the new BMW X6 will drive across the top of the screen as part of a reverse stock ticker - a first for any advertiser. Additionally, BMW is the first automotive company to sponsor a taping of CNBC-TV's "Power Lunch," on location recently at The Four Seasons Restaurant in New York City, where real-life power lunches take place everyday. The new BMW X6 was on display.

On the West Coast, a media partnership with Variety will introduce the BMW X6 to target consumers in the entertainment industry as part of the latest installment of the "10 to Watch" series, "10 Innovators to Watch," in both print and online editions dated May 5th. To extend the partnership with the leading entertainment industry trade, BMW will join Variety in supporting the Consumer Electronics Association's Digital Hollywood Conference in Los Angeles from May 5th-8th. BMW will be the exclusive automotive sponsor of the conference, will stage an X6 display in front of the conference venue and, along with Variety, a Digital Hollywood media partner, will host a "10 Innovators to Watch" panel discussion followed by a cocktail party.

Aggressively styled print ads telegraph the attitude of the new vehicle with bold taglines like "Coupe's evil twin" and "What is it? What isn't it" set in a heavy typeface. The ads will appear in April, May, and June issues of national business/financial, lifestyle and automotive enthusiast magazines, including: Forbes, The Economist, Cond?® Nast Portfolio, Robb Report, The New Yorker, Cigar Aficionado, Automobile, and Road and Track.

A national cable television spot, directed primarily at viewers of business, news and sports networks, supplements the campaign. The 30-second piece, entitled "Clay," shows a lump of clay morphing between a variety of vehicle shapes, evoking the BMW X6's performance-based roots, until finally landing on the distinctive form of the sports activity coupe. The clay model is replaced by a Vermillion Red Metallic BMW X6, and a voiceover says, "The coupe has been reshaped. The all-new BMW X6." The spot will appear on such national cable television networks as Bloomberg, MSNBC, CNBC, CNN, Fox News, ESPN, NFL Draft on NFL Network, The Golf Channel, NBA Playoffs on TNT, and the Speed Channel.

Other highlights of the comprehensive ad campaign for the 2008 BMW X6 include:

* Spots on the Captivate Network, which delivers news, entertainment, and advertising to digital screens in the elevators of premier office towers in North America's top 23 markets.

* A specially designed BMW X6 web site for Apple iPhone users, and the ability to drive information direct to other "smart phone" devices in response to a text message inquiry from the user.

* A prominent banner ad on the Bloomberg Terminals relied on by members of the financial community for real-time and historical stock information.

* A BMW sponsorship of Morningstar.com's premium subscription content that will make it available to users free of charge from April 29th - June 7th, and will feature an animated BMW X6 that will drive across the screen when users submit stock information inquiries.

* An online presence through financial page takeovers of business and financial web sites like LinkedIn.com, Forbes.com, TheStreet.com, and Morningstar.com. Also, online creative will appear in Variety.com and select in-market automotive web sites.

* Airport billboards that proclaim "After you land, fly" and "The goose bumps begin at deplaning" are slated to appear in 15 airports covering 10 domestic markets.

A virtual design studio tour on the BMW web site will allow visitors an inside look at the design and development of the BMW X6. Modeled on the BMW design studio in Munich where the world's first sports activity coupe was conceived, the interactive piece will be available at: http://www.bmwusa.com/Standard/Content/AllBMWs/FutureVehicles/X6/X6TeaserExplore.aspx#studio

BMW Website Review:

BMW Sauber F1

BMW Motorsport

BMW Yachtsport

BMW Golfsport

BMW Oracle Racing

BMW Sport website

worldofbmw.com: Kicking around in Karoo

Talks Brian Cox: What really goes on at the Large Hadron Collider

<!--cut and paste--><object classid="clsid:d27cdb6e-ae6d-11cf-96b8-444553540000" codebase="http://download.macromedia.com/pub/shockwave/cabs/flash/swflash.cab#version=8,0,0,0" width="432" height="285" id="VE_Player" align="middle"><param name="movie" value="http://static.videoegg.com/ted2/flash/loader.swf"><PARAM NAME="FlashVars" VALUE="bgColor=FFFFFF&file=http://static.videoegg.com/ted/movies/BrianCox_2008_high.flv&autoPlay=false&fullscreenURL=http://static.videoegg.com/ted/flash/fullscreen.html&forcePlay=false&logo=&allowFullscreen=true"><param name="quality" value="high"><param name="allowScriptAccess" value="always"><param name="bgcolor" value="#FFFFFF"><param name="scale" value="noscale"><param name="wmode" value="window"><embed src="http://static.videoegg.com/ted2/flash/loader.swf" FlashVars="bgColor=FFFFFF&file=http://static.videoegg.com/ted/movies/BrianCox_2008_high.flv&autoPlay=false&fullscreenURL=http://static.videoegg.com/ted/flash/fullscreen.html&forcePlay=false&logo=&allowFullscreen=true" quality="high" allowScriptAccess="always" bgcolor="#FFFFFF" scale="noscale" wmode="window" width="432" height="285" name="VE_Player" align="middle" type="application/x-shockwave-flash" pluginspage="http://www.macromedia.com/go/getflashplayer"></object>

How do I learn more about becoming a BMW motorcycle dealer?

BMW Motorrad USA regularly performs market studies to determine the optimal locations in which to open new BMW motorcycle dealerships.

At this time, BMW motorcycles is seeking qualified candidates for the establishment of a new dealership in Cincinnati, Ohio; Duncansville, PA; Ocala, Florida; Philadelphia, PA; and Leesburg, Virginia.

If there are other markets that interest you, please send a letter of interest indicating the specific market along with your resume and personal financial statement to:

Dealer Development Manager | BMW Motorrad USA

P.O. Box 1227

Westwood, NJ 07675 - 1227

Please note that at this time we are only accepting applications from individuals with established motorcycle industry experience.

BMW PressClub

BMW G 650 XCHALLENGE OFFERS OFF-ROAD PATROL BENEFITS TO BAKERSFIELD, CA POLICE DEPARTMENT

04/29/2008

Woodcliff Lake, NJ - April 29, 2008... Bakersfield, CA police officers are now patrolling the bikeway along the Kern River with greater ease and safety, thanks to two new BMW G 650 Xchallenge motorcycles recently delivered to the department by Valley Cycle and Motorsports in Bakersfield.

According to Frank Stevens, Authority Program Manager for BMW Motorrad USA, the Bakersfield Police Department is the first law enforcement agency to purchase the G 650 Xchallenge for patrol purposes.

ÔÇ£We have sold the F 650 GS-P -- also an agile, multi-terrain motor -- to law enforcement agencies for many years,ÔÇØ commented Mr. Stevens, ÔÇ£but the G 650 Xchallenge offers greater off-road capabilities with longer suspension travel and higher ground clearance for more aggressive off-road riding.ÔÇØ

ÔÇ£Officers will be patrolling the entire Kern River bottom on motorcycles equipped with patrol lights, anti-lock brakes and radios,ÔÇØ said Bill Abshier, owner and general manager of Valley Cycle and Motorcycles. ÔÇ£We hope to be successful adding R 1200 RT-P models to the Bakersfield Police DepartmentÔÇÖs street bike fleet in the near future.ÔÇØ

The BMW G 650 Xchallenge - a runner-up in the "Best Dirtbike" category for Motorcyclist magazineÔÇÖs 2007 Motorcycle of the Year Award ÔÇô is BMWÔÇÖs most modern and aggressive dual sport bike, distinguished by its outstanding off-road riding performance and its air damping system.

BMW police motorcycles are currently used by more than 400 agencies throughout the United States, including the State of Washington, Oregon, California, Arizona, New Mexico, Nevada and Idaho to name a few.

For more information about the features and benefits of BMW police motorcycles, visit BMWÔÇÖs exclusive police motors website at www.bmwmc.net or learn more about the complete line of BMW motorcycles at www.bmwmotorcycles.com.

3-D VIRTUAL TOUR OF FIRST-EVER BMW X6 TO ROLL INTO LOBBIES OF BUILDINGS NEAR WALL STREET AS CENTERPIECE OF AD CAMPAIGN

04/29/2008

BMW of North America Banking on Dynamic Hologram of World's First Sports Activity Coupe to Reach Target Consumers in Financial Community

Woodcliff Lake, NJ - April 29, 2008... BMW of North America and its advertising agency GSD&M Idea City are rolling out a 3-D virtual vehicle tour to herald the arrival of the first-ever BMW X6. Going direct to target consumers with a hologram of the vehicle, the world's first sports activity coupe will be featured in prominent buildings in New York City's financial district over a four-week period.

Employing patented technology from Dutch advertising company viZoo, the 2008 BMW X6 will be projected in three dimensions, appearing as a hologram, inside a ten-foot square, BMW-branded enclosure. Inside the light-controlled space, an animation suggesting the vehicle's unique combination of coupe agility and sports activity vehicle versatility runs on a loop.

"Busy finance executives represent an important sampling of the target consumers for the new BMW X6," said Jack Pitney, Vice President, Marketing, BMW of North America. "Since these prospective buyers rarely have time to visit a dealer showroom, our virtual tour allows them to 'experience' the performance, agility and utility of the X6 by bringing the showroom to them."

An interactive touch-screen inside the enclosure will allow people to manipulate the vehicle hologram to view different angles, experience the interior, explore the vehicle features, and get a sense of the generous cargo space.

"The BMW X6 doesn't look like anything BMW has ever produced - you have to see it to believe it," said Duff Stewart, President and COO of GSD&M Idea City. "Our goal was to put this amazing vehicle in front of its best prospects and stop them in their tracks."

The BMW X6 virtual tours will be open in each New York City location on Monday through Friday during regular office hours, and will be staffed by brand ambassadors during peak times. The building locations and dates are as follows:

* World Financial Center (225 Liberty St.) from April 21st - April 25th

* 245 Park Ave. from April 28th - May 2nd

* 1 Liberty Plaza from May 5th - May 9th

* 1 New York Plaza from May 12th - May 16th.

A media partnership has been forged with CNBC-TV to help further the BMW X6's reach among members of the financial and business community. On the television news network, the new BMW X6 will drive across the top of the screen as part of a reverse stock ticker - a first for any advertiser. Additionally, BMW is the first automotive company to sponsor a taping of CNBC-TV's "Power Lunch," on location recently at The Four Seasons Restaurant in New York City, where real-life power lunches take place everyday. The new BMW X6 was on display.

On the West Coast, a media partnership with Variety will introduce the BMW X6 to target consumers in the entertainment industry as part of the latest installment of the "10 to Watch" series, "10 Innovators to Watch," in both print and online editions dated May 5th. To extend the partnership with the leading entertainment industry trade, BMW will join Variety in supporting the Consumer Electronics Association's Digital Hollywood Conference in Los Angeles from May 5th-8th. BMW will be the exclusive automotive sponsor of the conference, will stage an X6 display in front of the conference venue and, along with Variety, a Digital Hollywood media partner, will host a "10 Innovators to Watch" panel discussion followed by a cocktail party.

Aggressively styled print ads telegraph the attitude of the new vehicle with bold taglines like "Coupe's evil twin" and "What is it? What isn't it" set in a heavy typeface. The ads will appear in April, May, and June issues of national business/financial, lifestyle and automotive enthusiast magazines, including: Forbes, The Economist, Cond?® Nast Portfolio, Robb Report, The New Yorker, Cigar Aficionado, Automobile, and Road and Track.

A national cable television spot, directed primarily at viewers of business, news and sports networks, supplements the campaign. The 30-second piece, entitled "Clay," shows a lump of clay morphing between a variety of vehicle shapes, evoking the BMW X6's performance-based roots, until finally landing on the distinctive form of the sports activity coupe. The clay model is replaced by a Vermillion Red Metallic BMW X6, and a voiceover says, "The coupe has been reshaped. The all-new BMW X6." The spot will appear on such national cable television networks as Bloomberg, MSNBC, CNBC, CNN, Fox News, ESPN, NFL Draft on NFL Network, The Golf Channel, NBA Playoffs on TNT, and the Speed Channel.

Other highlights of the comprehensive ad campaign for the 2008 BMW X6 include:

* Spots on the Captivate Network, which delivers news, entertainment, and advertising to digital screens in the elevators of premier office towers in North America's top 23 markets.

* A specially designed BMW X6 web site for Apple iPhone users, and the ability to drive information direct to other "smart phone" devices in response to a text message inquiry from the user.

* A prominent banner ad on the Bloomberg Terminals relied on by members of the financial community for real-time and historical stock information.

* A BMW sponsorship of Morningstar.com's premium subscription content that will make it available to users free of charge from April 29th - June 7th, and will feature an animated BMW X6 that will drive across the screen when users submit stock information inquiries.

* An online presence through financial page takeovers of business and financial web sites like LinkedIn.com, Forbes.com, TheStreet.com, and Morningstar.com. Also, online creative will appear in Variety.com and select in-market automotive web sites.

* Airport billboards that proclaim "After you land, fly" and "The goose bumps begin at deplaning" are slated to appear in 15 airports covering 10 domestic markets.

A virtual design studio tour on the BMW web site will allow visitors an inside look at the design and development of the BMW X6. Modeled on the BMW design studio in Munich where the world's first sports activity coupe was conceived, the interactive piece will be available at: http://www.bmwusa.com/Standard/Content/AllBMWs/FutureVehicles/X6/X6TeaserExplore.aspx#studio